If you’re looking to expand or relocate your business, funding the project may be one of the biggest hurdles.

To help save costs and make an impact on a local community, you may want to consider including tax credits and incentives as a part of your business expansion strategy.

Explore your options to leverage credits and incentives and key considerations when claiming them:

- Business expansion considerations

- Triggers for credits and incentives

- Types of incentive opportunities

- Examples of tax incentives

- New Markets Tax Credit (NMTC) overview

- Location study overview and process

Business Expansion Considerations

As you begin to develop a business expansion strategy, there are location-related factors as well as tax implications to consider. Many local jurisdictions have an economic development office which can help provide helpful information on these factors. Some of these considerations include:

Workforce

- Determine cost, availability, expertise

- Unemployment rates

- Quality of life

- Degree attainment, colleges, and universities

Real Estate

- Locate suitable space for existing operations

- Opportunities for future growth and expansion

Geography

- Analyze new or strategic geographic regions critical to business growth

- Assess proximity to customers, suppliers, transportation hubs, and more

Tax Implications

- Assess state and local tax impacts

- Better understand the full cost of doing business

Incentives

- Identify financial incentives to offset costs

- Assess availability of nonfinancial incentive programs such as permit expediting

Triggers for Credits and Incentives

As you assess possible project locations, there are a number of factors that might influence the availability, amount, and type of incentives your business might be able to attract.

While this list isn’t exhaustive, the ability to speak about your project’s impacts will weigh heavily on the availability and amount of credits and incentives it may be able to receive.

Workforce

- Job creation—typically 25 or more jobs

- Job retention or replacement

- Job transfers

- Employee training

Capital Expenditures

- Equipment expenditures

- R&D

- Infrastructure improvement

- Green investment, such as solar, wind, or EV chargers

New Geography or Market

- New geographic regions

- Introduction of new services or products

- Mergers and acquisitions

Real Estate Transactions

- Relocation

- Expansion

- Redevelopment

- Consolidation

- Lease expiration

Types of Incentives

The incentives offered by state and local jurisdictions, typically fall into two categories:

- By right

- Negotiated

Statutory

These incentives are provided to companies by right if they meet certain defined statutory requirements.

For example, some incentives are applicable to certain industries. Other statutory incentives may be available to a company that hires individuals with certain backgrounds, such as veterans.

Some statutory incentives may also require pre-approval or pre-certification before the company makes any investment or begins hiring.

Discretionary

Discretionary incentives are customized financial packages negotiated with state and local government agencies.

These are typically executed prior to making a location decision, such as before making an announcement, signing a lease, or breaking ground on construction. These packages may contain several types of incentives which will typically offset the taxes and fees levied by the state or local jurisdiction.

Examples of Tax Incentives

There are a variety of grants, credits, and incentives available. Being aware of these opportunities could have a positive impact on your organization’s cash flow.

Cash Incentives

- Discretionary grants for job creation and retention

- Discretionary grants for capital investment

- Infrastructure assistance, including roads, water, and wastewater

- Permit and impact fee waivers

- Vehicle, forklift, and vehicle supply equipment replacement grants

Tax Incentives

- Hiring tax credits

- Payroll tax rebates

- Income and franchise tax credits for capital investment and targeted activities

- Sales and use tax refunds and exemptions

- Real and personal property tax abatements and rebates

- Federal and state zone credits

- R&D tax credits

- Gross receipts tax credits

Training Benefits

- Training cash grants. Performance-based contracts that provide reimbursement of prospective training expenditures

- Training tax credits. Retroactive and prospective; a percentage of wages paid to the employee receiving training can be used to reduce a company’s in tax liability

- In-kind services. No- or low-cost service for curriculum development

Financing

- Tax Increment Financing (TIF)

- Free or discounted land or building

- Forgivable loans

- Industrial Revenue Bonds (IRB)

- NMTC

- Reduced import tariffs and customs duties

- Tax privileged enterprise zones

Green Initiatives

- Inflation Reduction Act tax credits

- Utility rebates or discounts

- Energy efficiency credits and grants

- Credits and grants for investments in renewable energy property

- Pollution control tax credits and abatements

- Recycling tax credits

NMTC Overview

The NMTC is a financing tool that could make implementing your business expansion strategy more cost-effective.

Under IRC Section 45D, the NMTC was created as part of the Community Renewal Tax Relief Act of 2000. It was designed to spur investments in traditionally underserved, low-income communities and creates a 39% tax credit to investors for qualified equity investments in these communities.

To qualify for NMTC financing, a business must be located in or serve a qualified low-income community. While obtaining NTMC financing is very competitive, it can yield a significant benefit to projects that receive NMTC financing. At the end of the seven-year compliance period, the investor equity in the NMTC structure is typically forgiven and the project retains the net benefit, which can be as high as 15–20% of the NMTC allocation amount.

For in-depth information on NMTC, including eligibility, requirements, project specifics, and more, read How the New Markets Tax Credit Stimulates Businesses and Communities.

Location Study

Deciding where to relocate or expand your business, a location study is an important first step and can help identify potential credits and incentives that your project might qualify for.

Engage Stakeholders

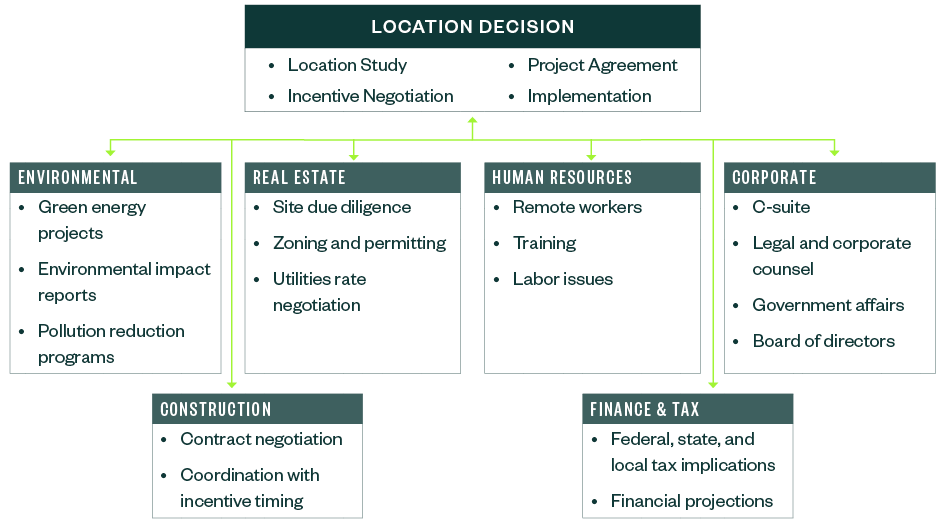

Before conducting a location study, engage stakeholders from across the organization.

Location Study Process

The process of conducting a location study includes three phases—location analysis, execution, and post-decision ongoing maintenance.

Location Analysis

The three steps to a location analysis are defining project objectives, analyzing potential locations, and eliminating options that don’t meet the criteria.

Define

- Define project objectives

- Identify and engage internal stakeholders

- Determine preliminary location criteria and initial geographic scope

- Assess geographic scope; weigh and score locations

Analyze

- Refine project objectives, milestones, and deadlines

- Send a request for information (RFI); outline company objectives and site requirements

- Evaluate RFI responses

- Create short list

Eliminate

- Refine short list and eliminate states without compatible sites

- Conduct site tours, initiative incentive discussions

- Send a request for proposal (RFP) focusing on incentives, identifying any specific challenges or site shortcomings

- Perform cost-based analysis based on RFP response

Execution

- Commence incentive negotiations

- Provide economic impact analysis to demonstrate projects total impact

- Conduct final site visits

- Draft and negotiate project agreements; tailor incentives to address specific needs

- Revise cost comparison

- Select final site including coordinating announcements, groundbreakings, etc.

Post-Decision and Ongoing Maintenance

- Identify an internal compliance champion responsible for generating compliance reports

- Comply with annual reporting requirements to earn and utilize provided incentives

- Review agreements periodically to ensure alignment with business plans

- Advise state and local representatives with any changes

We’re Here to Help

For guidance on how to include credits and incentives in your business expansion strategy, contact your Moss Adams professional.